Income Tax & Payroll Preparation from Erie, PA

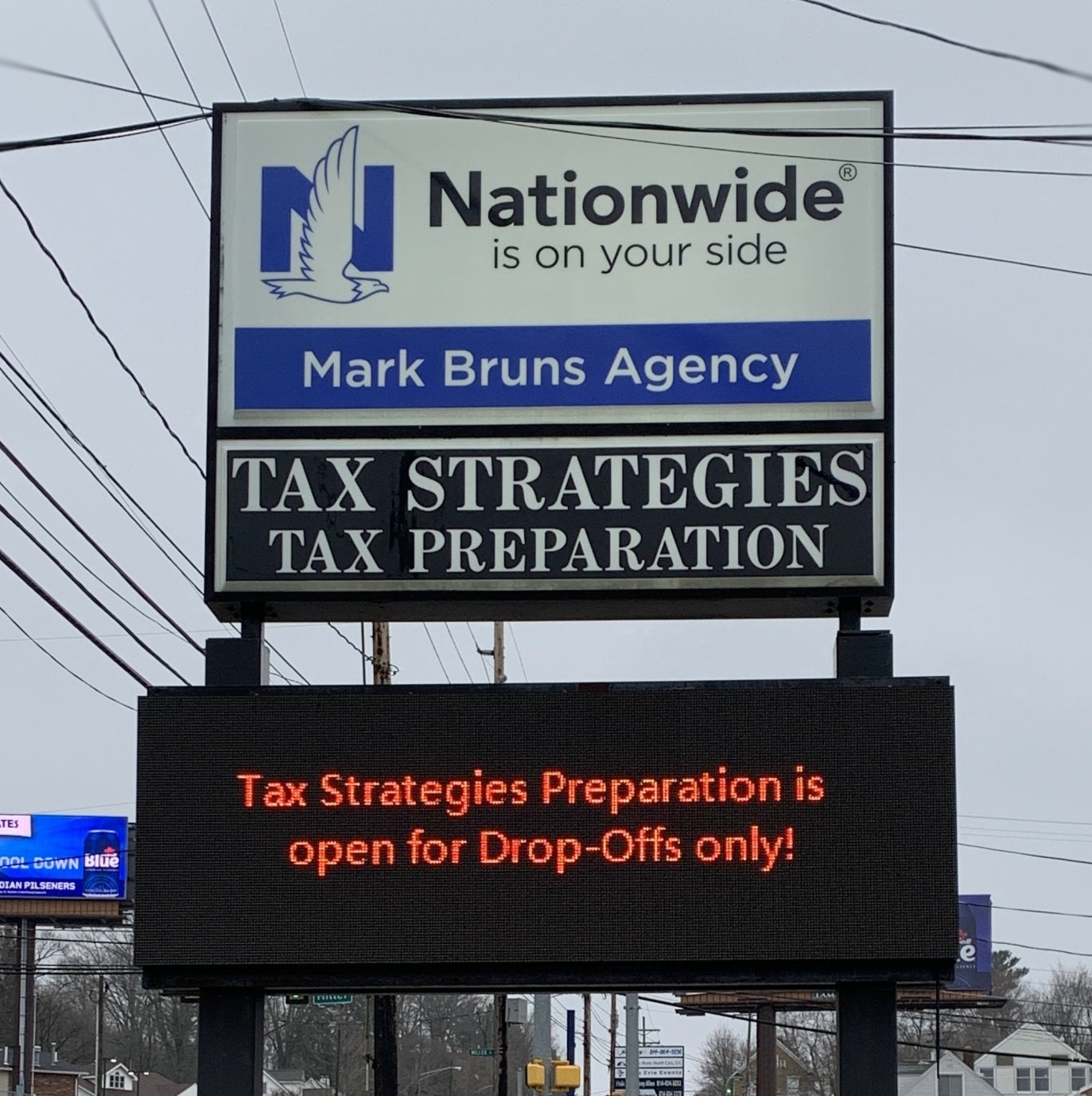

Let us handle all of your tax preparation services. At Tax Strategies Preparation in Erie, Pennsylvania,

we offer payroll preparation and income tax services for all types of individuals and businesses. You can make an appointment, walk in, or drop off your tax information.

Preparing Your Forms

- W-2

- 1099

- 1098

- Mortgage Interest Statements

- Bank Statements

- Charitable Contributions

- Property Taxes

- Business Returns—1120s

- Partnership Returns—1065

What to Bring:

- Photo ID for each tax filer

- Any charitable cash donation amounts

- Form 1095-A (if you purchased health insurance through the Health Insurance Marketplace)

- Birth Dates for everyone listed on tax return

- All Income Statements

- All records of expenses such as mortgage interest, tuition, real estate taxes

- A copy of last year's federal and state tax returns*

- A voided or blank check*

- Total paid for daycare provider and daycare provider's name, address, employer

- Adoption expenses

- Alimony paid/received

- Any notices received from the IRS

- Property Tax Bills

- College tuition and student loan interest statements

- Additions forms of income such as: prizes and awards, scholarships, lottery/gambling winnings

*New Clients Only

Our Schedule

Our specialists run heavily six days a week from January through April 15th, but we are still here for you in the off-season. As we aren't a big chain, we charge 25% to 50% less than national companies.

Affordable Prices

2025 Prices

Due to several changes in Tax Law this year prices will vary based on your specific return. Please see your individual preparer for price quoting!

Payroll Preparations

- 941 & W-2 Form Preparation for Small Businesses

- Biweekly Payroll Preparation

- Quarterly Tax Reporting

- Weekly Payroll Preparation